Getting into the Housing Market

Whether it is your first or subsequent venture into the housing market, it will likely look a bit different than it did even a few years ago.

Rising interest rates and changing qualification rules mean you may have to wait a bit longer, or rely on help from family.

This week I had a call with a young lady that is looking to buy a home in the Okanagan. She said she has been saving her down payment but feels like it will take a while to save enough. She also said she needed some help trying to figure out a game plan.

What I most appreciated about the call was her realistic approach. She said she felt it would be two to three years before she would be ready to move forward with a purchase and wanted to make sure she was doing everything she could to get ready.

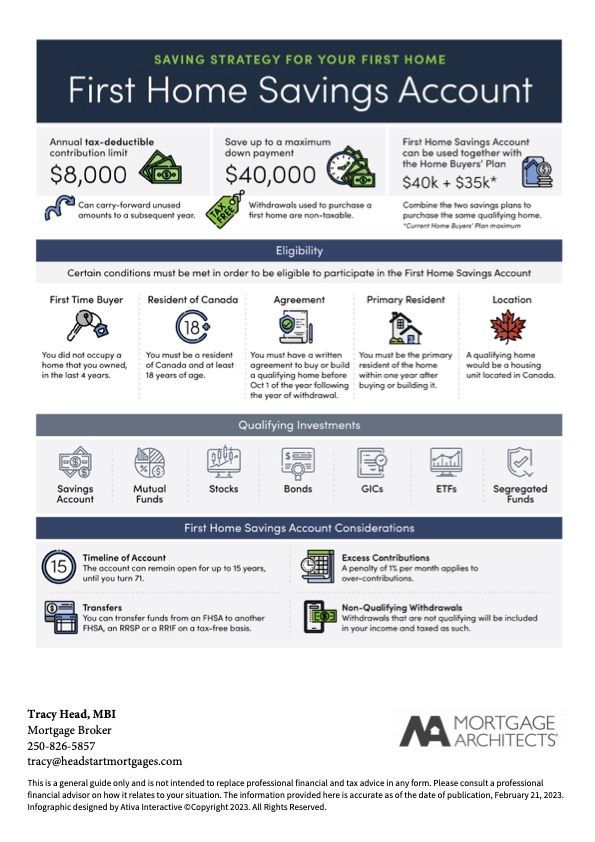

The same day I sat in on a learning session about the First Home Savings Account (FHSA). Starting April 1, 2023 Canadians can contribute up to $8000.00 per year to a maximum of $40,000.00 to be used towards the down payment on a home. The contributions are tax deductible.

Who can open an FHSA? You must be:

- Between 18 and 71 years of age

- A resident of Canada

- Considered a First Time Home Buyer

How do you open an FHSA?

Contact any FHSA issuer. This can be a bank, credit union, or a trust or insurance company. They will be able to advise you as to what type of savings or investment products your money can be invested in. The funds in your FHSA can be combined with funds withdrawn from RRSPs under the Home Buyers Plan (HBP) to be used towards your down payment. The total between the two would be $75,000.00 or $150,000.00 per couple.

These may seem like pie-in-the-sky numbers, but even leveraging the plans for part of those funds may help significantly with the purchase of your home. Saving your down payment can be a real challenge, particularly if you are renting. The cost of living is

increasing and making it more difficult to tuck money away. When life happens it can be tempting to dip into your down payment savings.

A significant advantage to opening a FHSA or contributing to your RRSP is that it is not so easy to dip into your down payment savings. Perhaps an even more significant advantage is that your contributions are tax deductible which ultimately helps your savings plan.

Check out highlights of the First Home Savings Account here.