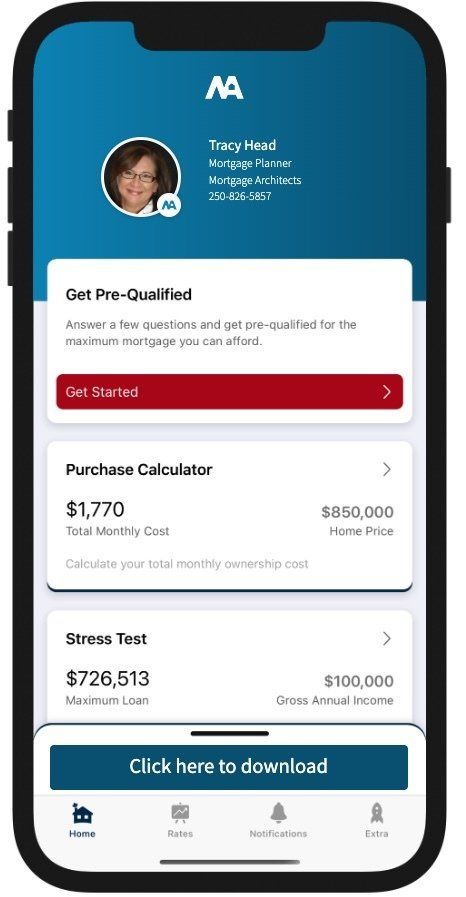

By Tracy Head

•

December 23, 2025

After more than two decades as a mortgage broker in Canada, I can tell you this: the questions I’m getting today are different from the ones I heard five or even three years ago. They’re more urgent. More personal. And often, more anxious. It’s not that Canadians suddenly forgot how mortgages work. It’s that we’re in a period of change — and change creates uncertainty. With so many mortgages coming up for renewal over the next couple of years, interest rates still higher than what people grew used to, and household budgets already stretched, clients want clarity. They want to understand how their financial lives might look one, two, or three years from now — and what they can do now to avoid being caught off guard. Here are some of the most common questions I’m asked right now: “How bad is my renewal going to be?” This is, without question, the number one concern. Many homeowners took out five-year fixed mortgages between 2019 and 2021, when rates were historically low. At the time, locking in under 2% felt smart — and it was. The challenge is that those mortgages are now coming due in a very different rate environment. Clients want to know: How much will my payment increase? Can I absorb that increase without changing my lifestyle? Is there anything I can do to soften the blow? The honest answer is that some people will see a noticeable jump in payments, especially if they haven’t reduced their balance much. For others, the increase is manageable — but only with planning. That’s why I encourage clients to look at their renewal at least a year in advance. The earlier we run the numbers, the more options we have. “Should I go fixed or variable this time?” This question never really goes away, but it’s taken on new meaning lately. People aren’t just asking about rates — they’re asking about peace of mind. After the rollercoaster of the past few years, many borrowers are prioritizing predictability over squeezing out the absolute lowest possible rate. Some are still open to variable rates, especially if they believe rates may continue to ease over time. Others want the certainty of a fixed payment so they can plan their budgets with confidence. There’s no universal right answer — the best choice depends on your income stability, risk tolerance, and how tight your monthly cash flow already is. What I remind people is this: choosing a mortgage isn’t about guessing the future perfectly. It’s about choosing an option you can live with even if things don’t go exactly as expected. “Can I still afford my home long-term?” This is where the conversation gets more personal. Rising mortgage payments don’t happen in a vacuum. Clients are also dealing with higher grocery bills, insurance costs, childcare expenses, and everything else that seems to cost more than it used to. So naturally, they’re asking whether their home still fits comfortably within their overall financial picture. For some, the answer is yes — with a few adjustments. For others, it means deeper discussions about amortization changes, refinancing strategies, or even downsizing down the road. None of these are failure scenarios. They’re planning conversations. One thing I stress is that affordability isn’t just about what a lender will approve. It’s about what allows you to sleep at night and still enjoy your life. “Is now a good time to buy — or should I wait?” First-time buyers and move-up buyers are asking this constantly. They’re watching rates. They’re watching home prices. They’re hearing headlines that point in different directions. What they really want is reassurance that they’re not making a mistake. My answer is always the same: the “right time” to buy is when it fits your life, your finances, and your timeline — not when the headlines look perfect. Trying to time the market is incredibly difficult, even for professionals. What buyers can control is how prepared they are, how conservative they are with their budget, and how well they understand their mortgage options. “What happens if things get tight?” This is one of the most important — and often unspoken — questions. Clients want to know what safety nets exist if their financial situation changes. What happens if a renewal payment feels overwhelming? What if income drops? What if life throws a curveball? This is where strategic planning comes in. We talk about: Building flexibility into mortgage terms Choosing products with reasonable prepayment options Keeping amortizations realistic Understanding lender policies before you need them The goal isn’t to assume the worst — it’s to make sure you’re not boxed in if circumstances change. “Do I really need a broker, or can I just renew with my bank?” This question comes up a lot, especially at renewal time. Banks make renewing easy — sometimes too easy. A quick email. A rate offer. A couple of clicks. What’s often missing is context. Is that rate competitive? Does that product fit your future plans? Are there better options available elsewhere? More clients are realizing that mortgage decisions today have longer-lasting consequences than they did when rates were ultra-low. They want advice, not just a rate quote. They want someone to help them think through the next three years, not just the next three months. Looking Ahead: The Next 1–3 Years What all these questions have in common is uncertainty about the near future. Canadians know their mortgages matter — not just to their housing costs, but to their entire financial lives. With so many renewals approaching and the day to day cost of living still elevated, people want to feel prepared, not surprised. As a broker, my role isn’t to predict the future. It’s to help clients understand their options, model different scenarios, and make choices that align with their real lives — not just spreadsheets. If there’s one thing I’ve learned over the years, it’s this: the best mortgage decisions are made early, thoughtfully, and with good advice. And in today’s environment, that guidance matters more than ever.