Get in touch

250-826-5857

tracy@headstartmortgages.com

Helping you get a headstart on homeownership!

Tracy Head Mortgage Broker

Let us help you find the best mortgage solution for your needs!

Tracy Head

Serving clients in Alberta & BC from my office in the Okanagan.

I love to help my clients achieve their dreams! My goal is to create client delight - to help make the process a smooth one, so my clients can focus on the things that matter most.

With over 10 years of experience as a mortgage broker and having bought and sold multiple homes myself, I understand the challenges and frustrations that come along with buying or refinancing a home.

Let me save you time and money by doing the research and walking you through the entire mortgage process.

Mortgage financing can be confusing, it doesn't have to be when you follow my plan.

Get started right away

The best place to start is to connect with me directly. The mortgage process is personal. My commitment is to listen to all your needs, assess your financial situation, and provide you with a clear plan forward.

Get a clear plan

Sorting through all the different mortgage lenders, rates, terms, and features can be overwhelming. Let me cut through the noise, I'll outline the best mortgage products available, with your needs in mind.

Let me handle the details

When it comes time to arranging your mortgage, I have the experience to bring it together. I'll make sure you know exactly where you stand at all times. No surprises. I've got you covered.

I can help you arrange

mortgage financing for the following services:

Let's get started.

Choose from any of the following options!

Initial Mortgage Consultation

A quick call up front will help to get things moving forward for you. We will chat about what you are hoping to accomplish, and cover the next steps!

Online mortgage application.

If you'd prefer to start the mortgage process by completing an online mortgage application, here's where we make that happen!

Book a call for an application

If you would like to complete your mortgage application over the phone, choose this option, we'll have time to discuss all your options!

I'm proud to be on the Board of

Mortgage Brokers across Canada working together to make a difference in the lives of those who need it most.

You’ve worked hard your whole life. You deserve to enjoy the retirement lifestyle you've always imagined.

We specialize in mortgage financing for Older Canadians.

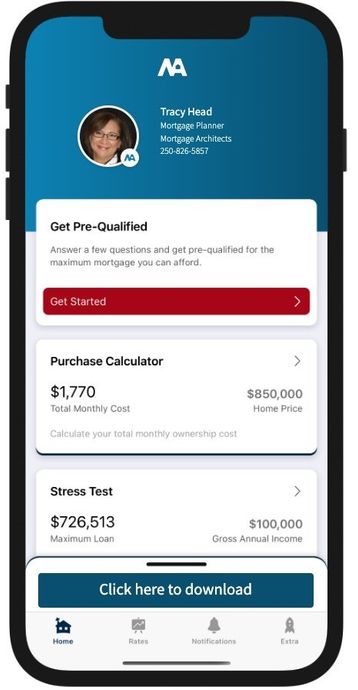

Download My Mortgage Toolbox

What can you do with my app?

Calculate your total cost of owning a home

Estimate the minimum down payment you need

Calculate Land transfer taxes and the available rebates

Calculate the maximum loan you can borrow

Stress test your mortgage

Estimate your Closing costs

Compare your options side by side

Search for the best mortgage rates

Email Summary reports (PDF)

Use my app in English, French, Spanish, Hindi and Chinese

You can keep up to date with all things mortgage related by reading my mortgage column.